transfer taxes refinance georgia

To make this rate a bit more practical lets take a couple of examples based on the median home value in several cities. The Automated Recordation Transfer Tax SystemARTS is designed to assist you in preparing your documents and payments for Prince Georges County Transfer and the State of Maryland Recordation taxes.

Who Pays The Transfer Tax In Orange County California

The tax applies to realty that is sold granted assigned transferred or conveyed.

. In other words you will only be responsible for paying revenue. Requirement that consideration be shown 48-6-3 - Persons required to pay real estate transfer tax. For example in Michigan state transfer taxes are levied at a rate of 375 for every 500 which translates to an effective tax rate of 075 375 500 075.

Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. Excess Energy Tax Refunds. Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens Plaza Atlanta GA 30326.

Title insurance is a closing cost for purchase and refinances mortgages. It might also be added that apparently there is a transfer tax if you refinance and go from a title in a persons name to a title in that persons TRUST. If the home value is 500000 or less the county transfer tax is 1 and if the home value is more than 500000 the transfer tax is 1425.

Atlanta Title Company LLC 945 East Paces Ferry Road Suite 2250 Resurgens Plaza Atlanta GA. 2400 12 680 034 None. How Much Are Transfer Taxes in Georgia.

The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. The borrower and lender must remain unchanged from the original loan. Refinance Mortgage Transfer Tax in Georgia.

Total transfer tax. For example Georgia property transfer tax is generally 1 per 1000 of real estate value while in New York City transfer taxes can range from 1425 percent to 2625 percent of a propertys value. Georgia Title Transfer Tax Intangibles Tax Mortgage TaxReal Estate Details.

A transfer tax is the city county or states tax on any change in ownership of real estate. 2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-2 - Exemption of certain instruments deeds or writings from real estate transfer tax. Georgia Transfer Tax Calculator.

Georgia Transfer Tax Calculator. However in most jurisdictions you must pay the State Revenue Stamps this amount varies by county on the new money being borrowed. 07th Sep 2010 0515 pm.

2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-1 - Transfer tax rate 48-6-2 - Exemption of certain instruments deeds or writings from real estate transfer tax. 13th Sep 2010 0328 am. Local state and federal government websites often end in gov.

Title Insurance 200 per thousand of loan amount. Title insurance rates will vary between title insurers in Georgia. In some states the transfer tax is known by other names including deed tax mortgage registry tax or stamp tax.

Atlantas median home value is 208100 which means the transfer tax would be around 208. The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or fractional part of 100. Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that you buy or sell.

Before sharing sensitive or personal information make sure youre on an official state website. The transfer tax rate in Georgia is 1 per 1000 of assessed value. The closing of a real estate transaction in Georgia must be performed by a licensed Georgia attorney.

Real Estate- Transfer taxes are negotiable in the contract but in most states the seller pays the tax if its not addressed in the contract. Regarding transfer taxes most jurisdictions in Maryland do not require you to pay new transfer taxes at the time of your refinance settlement. In a refinance transaction where property is not transferred between two parties no deedtransfer taxes are due.

These are not marginal tax rates so your respective tax rate is applicable to full home value. Intangible Tax 300 per thousand of the sales price. A property selling for 55000000 would incur a 55000 State of Georgia Transfer Tax.

To receive a refund of Excess Energy Taxes you must first qualify through the Maryland Department of Assessments and Taxation. Once the tax has been paid the clerk of the superior court or their deputy will attach to the deed instrument or other writing a certification that the tax has been paid. Intangibles Mortgage Tax Calculator for State of Georgia.

Georgia Transfer Tax On Refinance Real Estate. Georgia Transfer Tax 100 per thousand of sales price. A wide range of choices for you to choose from.

Who pays transfer tax at closing. This title calculator will estimate the title insurance cost for 1 - 4 unit residential and refinance transactions. I am refinancing my current mortgage and one of my potential lenders is stating that I need to a pay a mortgage transfer tax at closing.

Note that transfer tax rates are often described in terms of the amount of tax charged per 500. State of Georgia Transfer Tax. See GACode 48-6-1 Tax rate for real estate conveyance instruments Georgia Code 2013 Edition There is imposed a tax at the rate of 100 for the first 100000 or fractional part of 100000 and at the rate of 10 cents for each.

Find the formats youre looking for Transfer Taxes Refinance here. Easily estimate the title insurance premium and transfer tax in Georgia including the intangible mortgage tax stamps. The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note.

If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. Requirement that consideration be shown OCGA. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

Atlanta Title Company LLC 945 East Paces Ferry Road Suite 2250 Resurgens Plaza Atlanta GA 30326. If the holder of an instrument conveying property located both within and without the State of Georgia is a nonresident of Georgia the amount of tax due would be 150 per 50000 or fraction thereof of the principal of the note times x the ratio of the value of real property located in Georgia to the value of all real property in-state and out-of-state securing the note.

Who Pays What In The Los Angeles County Transfer Tax

What You Should Know About Contra Costa County Transfer Tax

Transfer Tax Who Pays What In Washington Dc

A Guide To Tennessee Real Estate Transfer Tax Felix

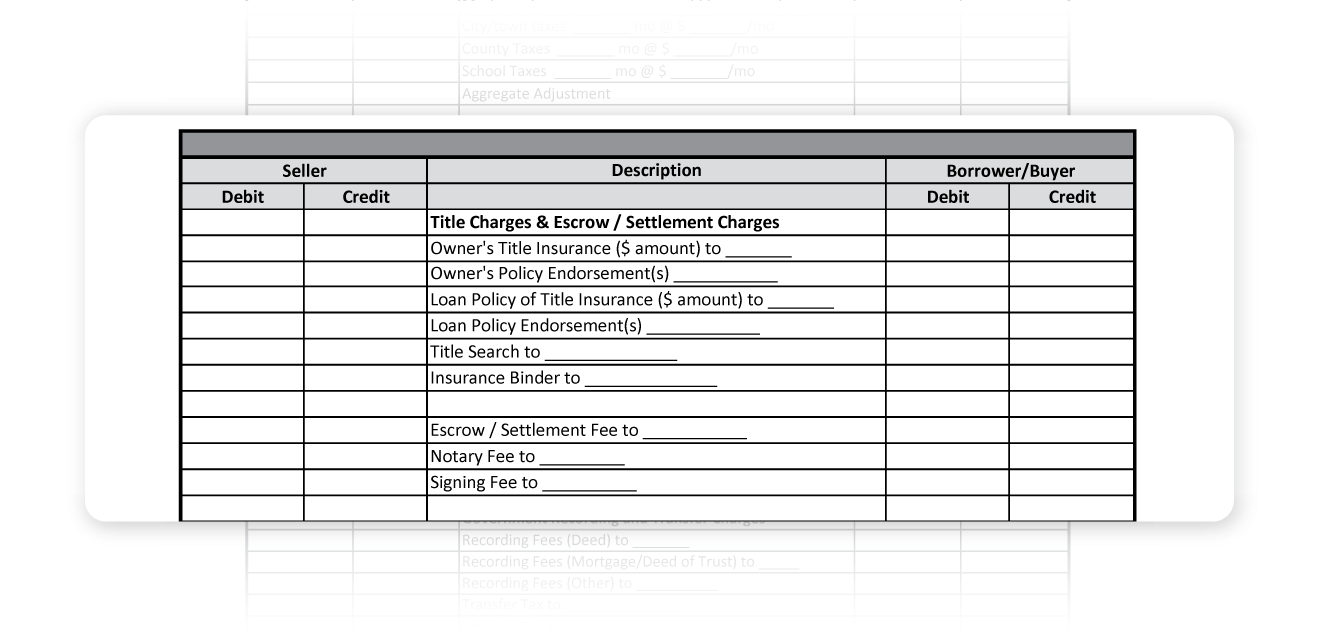

How To Read The Alta Settlement Statement Download Alta Statement

Who Pays What In The Los Angeles County Transfer Tax

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax

Virginia Real Estate Transfer Taxes An In Depth Guide

Florida Real Estate Transfer Taxes An In Depth Guide

What You Should Know About Santa Clara County Transfer Tax

Pennsylvania Deed Transfer Tax

Georgia Real Estate Transfer Taxes An In Depth Guide

Colorado Real Estate Transfer Taxes An In Depth Guide

Bill Of Sale Alabama Real Estate Forms Real Estate Forms Power Of Attorney Form Room Rental Agreement

Republic Of Madagascar 2017 Article Iv Consultation First Review Under The Extended Credit Facility Arrangement And Requests For Waiver Of Nonobservance Of Performance Criterion Modification Of Performance Criterion And Augmentation Of Access Press